Miaozhen Systems, a third-party technology company providing enterprises with marketing growth solutions based on big data and AI technology, has released two major reports evaluating and predicting upcoming social marketing and social influencer trends in 2022.

Miaozhen Systems, a third-party technology company providing enterprises with marketing growth solutions based on big data and AI technology, has released two major reports evaluating and predicting upcoming social marketing and social influencer trends in 2022.

The reports China Social & Content Marketing Trends 2022 and Key Opinion Leader Marketing Trends Report 2022 show that China will continue to see strong momentum in social marketing growth, with key opinion leader (KOL) promotions and short-form video campaigns being the key focuses in 2022.

"While social media marketing is still a strong marketing area for advertisers, the evaluation for KOL return on investment in cross-platform cases remains a challenge," said Jie Zhao, president of Miaozhen Systems.

Zhao added that if brands want to ensure the quality and effectiveness of social marketing, they need to make good use of social media platforms to grass seeding consumers by spotting the changing social trends, while improving their attribution analysis for their marketing campaigns.

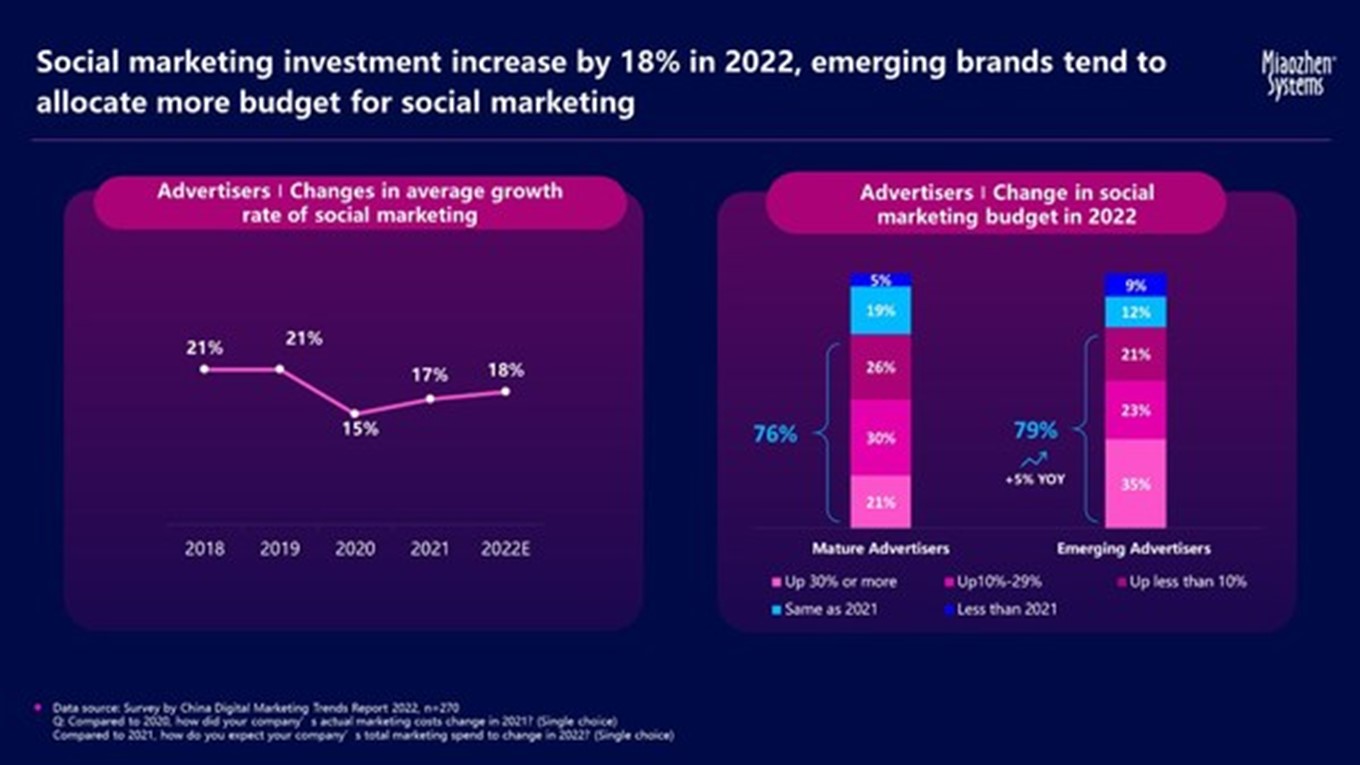

Notably, advertisers' social marketing investments are expected to continue to peak, increasing by 18% in 2022, according to Miaozhen's estimates. Advertisers in emerging brands are also likely to allocate more budget for social marketing. About 79% of all respondents from advertisers in emerging brands said they would increase such social marketing budget in 2022, increasing by 5% year-on-year.

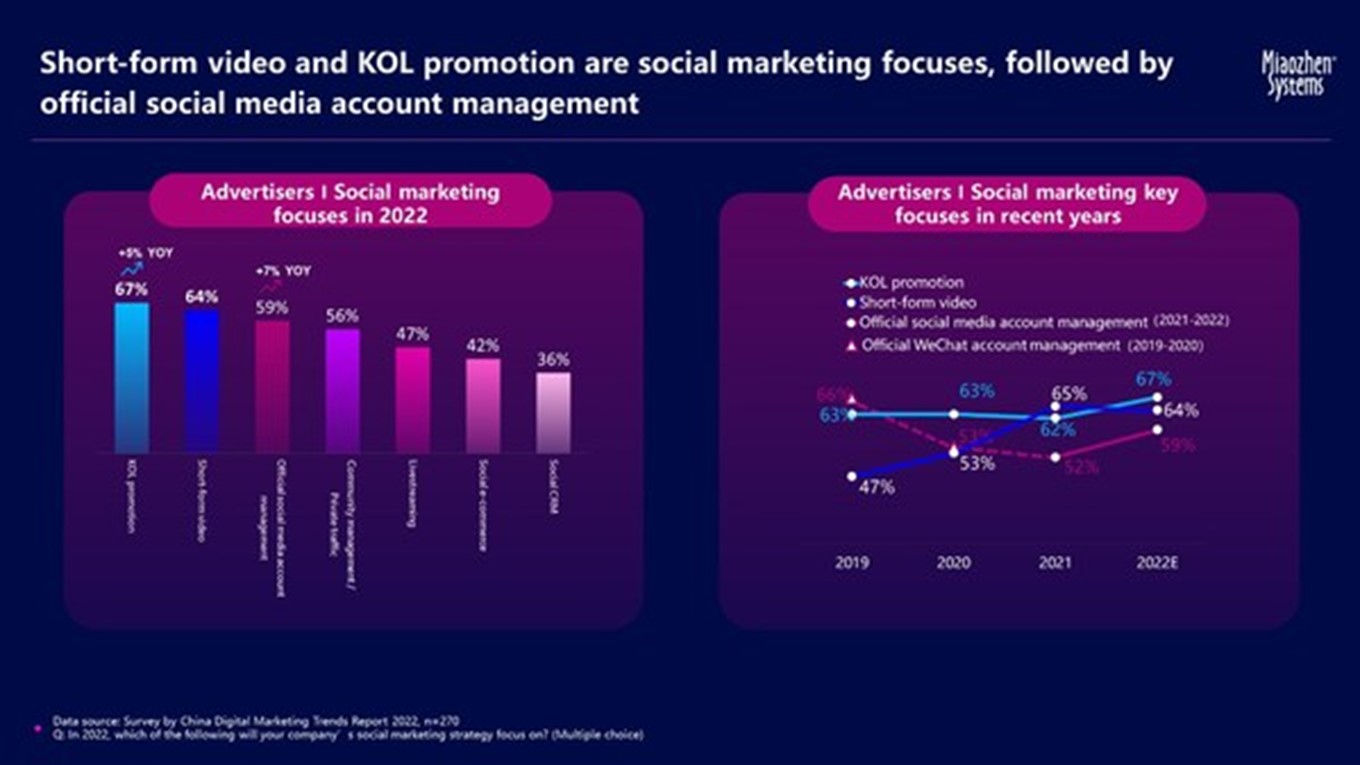

Meanwhile, the reports pointed out the three major social marketing focuses — KOL promotions, short-form videos, and official social accounts management — for the advertisers that look to champion in China.

KOL marketing is expected to be the first choice for advertisers in 2022 when it comes to social marketing, with 67% of respondents selecting the option (5% more than that of last year), followed by promoting through short-form videos and official social media accounts management.

For those advertisers that would like to promote in collaboration with influencers, 54% of respondents hoped the KOLs could help grass seeding consumers for specific products. To best advertise through KOLs, advertisers could pay attention to the varying user bases for different social platforms, the reports suggest.

For example, video-streaming site Bilibili can serve as a great platform for brands to communicate with younger consumers through creative content, while social media and e-commerce platform Little Red Book, China’s answer to Instagram, can help experienced influencers give out more recommendations in detail.

These platforms' rapid user growth also helps. In 2021, Bilibili and Little Red Book saw the numbers of their monthly active users grow by 112.1% and 59.9% year-on-year, respectively, according to the reports. The two mainly serve young users in China's first- and second-tier cities.

Industry-wise, the auto sector appears to favor Douyin, while consumer electronics advertisers tend to go for Bilibili. Little Red Book seems to particularly attract users mostly interested in cosmetics, parenting, food and beverages.

As more advertisers look to advertise through social media, the industry has seen more KOLs jumping into the business. In 2021, the total number of KOLs in China surged by 15% from that of the previous year, with the number of key opinion consumers (KOCs; tier-5 influencers) increasing by 5.5% year-on-year, according to the reports.

While many marketers continue struggling with evaluating the performances of KOL advertising, Miaozhen has developed a system to assess the efficiency for such promotions. With Miaozhen's Social ROI system, advertisers can easily conduct attribution analyses, by dissecting engagement data, incremental search UV (unique views) and a relevant performance index, to get more insights on the effectiveness of their KOL campaigns. (Source: Miaozhen Systems)

By MediaBUZZ