Experian recently presented The Digital Consumer View 2016 (Asia) report, with research and analysis by International Data Corporation (IDC), to help businesses better understand digital consumers in Asia.

Experian recently presented The Digital Consumer View 2016 (Asia) report, with research and analysis by International Data Corporation (IDC), to help businesses better understand digital consumers in Asia.

The report maps significant differences in how consumers research, locate, engage with and purchase products and services, based on surveys with over 1,200 digital consumers from Singapore, Malaysia, Indonesia, Thailand, Hong Kong, and China. These differences exist across channels (SMS, app notifications, email, social media, chat apps), devices (smart phone, feature phone, Wi-Fi/cellular tablet, wearable) and content (ads in email, ads in mobile apps, ads in social media, video ads on websites, and search ads). The findings highlight the complexity of reaching digital consumers in Asia across many channels, but also highlight how crucial that is.

Jeff Price, Managing Director of Southeast Asia at Experian, said, “Asia is in the midst of a great digital revolution, with an explosion of smart devices, social media interactions and e-commerce transactions. The beneficiary of this interconnectivity is clearly the digital consumer, but also businesses serving them. While this evolution has greatly enabled and empowered both sides, it has also challenged businesses to be more effective and targeted in the way they communicate and market to this modern, digital-savvy consumer. For companies to keep up with digital consumer behaviours – how they act on information – it’s absolutely vital to adopt and leverage what their consumers are providing them with every day – invaluable data. Businesses slow to act on this data will see their competitive advantage erode.”

Considering that Asia comprises 49.6% of the world’s Internet users, according to Internet World Stats (2016), and the assumption of IDC that digital commerce in the Asia-Pacific (excluding Japan) region will rise to US$17 trillion by 2019, up from US$7 trillion in 2015, Experian’s report should get a lot of attention. Besides, the combination of rising incomes, increased consumption, acceleration of internet use, and the proliferation of mobile broadband access continues to unlock tremendous opportunities for marketers across the continent.

Key findings on search and discovery, triggers of product interest and purchase intent, origin of deals and brand engagement across channels include:

- Search and discovery: Social media is the top channel in Singapore (31%), Malaysia (49%), Indonesia (67%) and Thailand (58%). It’s equally important as chat apps in China (47%); in Hong Kong, video ads (63%) trump all.

- Triggering product interest: Social media, once again, is the key driver in Singapore (28%), Malaysia (44%), Thailand (49%) and Hong Kong (25%). However, in Indonesia it’s SMS (62%), and in China it is chat apps (48%).

- Triggering purchase intent: Email is the biggest driver of online to offline conversion in Singapore (27%); SMS tops in Indonesia (57%); chat apps in China (45%); social media in Malaysia (44%) and Thailand (51%); and video ads tie with social media in Hong Kong (23%).

- Finding good deals: For unplanned purchases stemming from promotions, email leads in Singapore (34%); social media in Malaysia (50%), Indonesia (68%) and Thailand (58%); SMS in Hong Kong (36%), and social media in China (51%).

- Brand engagement: Email is key for marketers to build engagement in Singapore (58%) and Thailand (60%); chat apps in Malaysia (62%) and China (70%); banner ads in Indonesia (56%), and SMS in Hong Kong (61%). While email is important, marketers need to be wary: more than 70% of consumers reported receiving too many emails, up from 52% in 2015.

Key learnings for marketers in Asia

- Over-reliance on a single marketing channel will not work. Depending on the country and its current state of digital sophistication, marketers need to think carefully about the right mix of channels to employ.

- Quality over quantity. Consumer preferences for receiving promotional material varies from market to market, and by specific use cases. On a broader level, more is not necessarily better. A relevant and targeted message will ensure better conversion. Too much, and consumers are inclined to unsubscribe, delete, or mark content as spam.

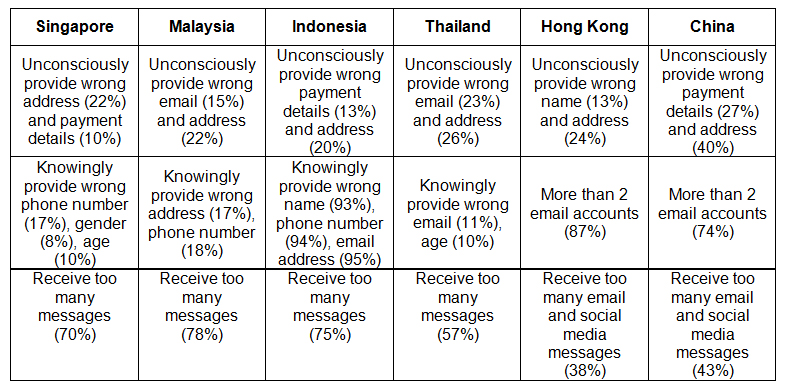

- The quality and integrity of data is crucial for marketers to find success. A significant number of consumers across the region either knowingly or unknowingly provide inaccurate information, which in turn causes errors and inaccuracies in marketer’s data sets. Around 27 percent of consumers in China but only 10 percent in Singapore unknowingly input wrong payment details; 40 percent of consumers in China, and over 20 percent of consumers in the rest of the region provide a wrong address at online checkout.

- Incredibly, almost all consumers in Indonesia provide marketers with wrong details: name (93%), phone number (94%) and email address (95%).

Comparison of key learnings and insights by market:

Source: Experian plc, Digital Consumer View 2016 (Asia)

Shiv Putcha, Associate Director, Consumer Mobility and Telco Strategy at IDC Asia Pacific, said, “Businesses and brands cannot afford to ignore Asia’s multi-trillion-dollar digital commerce market. China alone is now the world’s largest retail market. The challenge lies in the fact that the region has extraordinary differences – language, economy, purchasing power – and consumer behaviours, especially with the digital generation. That uniqueness will not diminish over the next few years and may even increase, making it challenging for marketers not using data-driven insights to research, plan and execute effectively. The Digital Consumer View 2016 (Asia) will hopefully serve as a valuable guide to deciphering some of these key trends, mapping the path forward for brands and their connected consumers.”

Marketers, particularly those in the retail sector, have to be more effective in engaging these digital consumers. Those who understand the quirks of each Asian market stand a better chance to find success – higher consumer engagement, happier customers, online to offline conversions and ultimately more money in the bank.

By MediaBUZZ