A new type of Internet access (mobile), a converted focus (local), and greater involvement of the Internet in everyday life (social), brought new movement to the Internet market, which is captured with the neologism "SoLoMo". Each of the three keywords it holds – social, local, mobile -represents an online area on its own, but their coalescence and interaction make them effective.

A new type of Internet access (mobile), a converted focus (local), and greater involvement of the Internet in everyday life (social), brought new movement to the Internet market, which is captured with the neologism "SoLoMo". Each of the three keywords it holds – social, local, mobile -represents an online area on its own, but their coalescence and interaction make them effective.

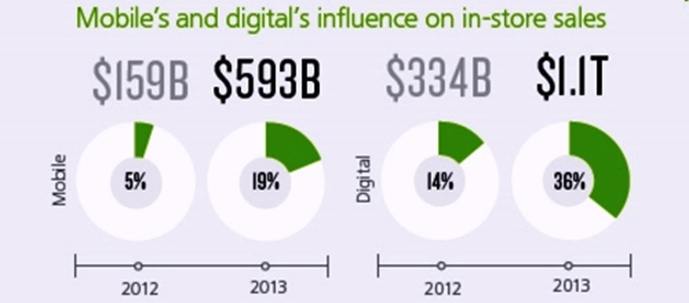

The growing popularity of mobile Internet technology is pivotal and induces the fundamental changes it brings, as Deloitte’s study "The New Digital Divide" confirms. This first-of-its-kind research quantifies the extent to which consumers' use of desktop and laptop computers, tablets, and smartphones influences brick-and-mortar store sales. Further, it reveals that digital devices’ influence on in-store purchase behavior is growing much faster than anyone could have anticipated.

According to Deloitte’s reserach, digital interactions influence 36 cents of every dollar spent in the retail store, or approximately $1.1 trillion, and this number is even expected to grow to 50% by the end of 2014.

Due to this acceleration, digital channels actually can’t be considered a separate or distinct business any longer, but fundamental to the entire shopping experience in and out of the store.

Digital shoppers bring higher store traffic, conversion and spending

Consumers using a device during their shopping journey convert at a 40% higher rate than those who do not use a device and a dramatic impact on traffic, spending and loyalty from digital shoppers has been discovered by Deloitte as well:

- 84% of store visitors use their devices before or during a shopping trip;

- 22% of consumers spend more as a result of using digital; just over half of these shoppers report spending at least 25% more than they had intended;

- 75% of respondents said product information found on social channels influenced their shopping behavior and enhanced loyalty.

"Each interaction is an opportunity for a retailer to enhance the customer experience and tell a brand story," said Jeff Simpson, director, Deloitte Consulting LLP and co-author of the study. "However, retailers often measure success solely on how many widgets they sell through their web or mobile sites. For example, retailers might regard online shopping cart abandonment as a failed conversion - when in reality it may represents a customer who just started his wish list in the online basket, but chose to purchase the items in the store. In that case, digital engagement may have led to a sale in the physical store. This impact is much higher when measured holistically across the organization and regardless of channels, rather than force-fitted to a single point of purchase."

Specialty stores are most digitally-influenced

Currently, more than 90% of retail sales occur in brick-and-mortar stores, but the surging digital influence calls upon retailers to redefine marketing, the store associate's role and in-store technology.

Consumers largely prefer to navigate the aisles and the checkout without a store associate's help. Eight in 10 (80%) respondents in Deloitte Digital's study said they prefer to obtain product information on their own device or from an in-store device like a kiosk, rather than ask a sales associate.

However, digital interactions are not "one-size-fits-all" and vary significantly by store category. For instance, the highest influence via devices occurs in specialty stores – and here especially those selling electronics/appliances (58 %), followed by furniture (56%) and sporting goods (50%), while the impact is lower in categories like health/personal care/drug (35%), grocery (29%) and general merchandise/department/warehouse clubs (23%).

E-Commerce and bricks-and-mortar businesses are no longer isolated

From the customer’s point of view, e-Commerce and bricks-and-mortar businesses are no longer isolated and this fact challenges many retailers today. Based on their findings, Deloitte Digital advises retailers to change dramatically the way they think, measure, and invest in digital, besides urging them to address their customers’ digital needs and wants properly.

Indeed, retailers are often failing to measure the impact of digital accurately on various measures of success, such as traffic, conversion, order size, and loyalty. But viewed holistically, these metrics can be powerful leading indicators of customer preference and purchase intent.

To no surprise, looking solely at smartphones, industry estimates put mobile commerce sales at roughly $40 billion today. By comparison, Deloitte Digital's data indicates that mobile-influenced sales in the store have reached $593 billion, suggesting that smartphones' influence on store sales has far surpassed the rate at which consumers make a purchase directly on their phones.

Kasey Lobaugh, principal, Deloitte Consulting LLP and Deloitte Digital's chief retail innovation officer explains: "Mobile and online transactions represent only a sliver of total retail revenue potential. Retailers that narrowly focus on digital commerce – rather than the full journey that leads to a purchase – often fail to recognize how their customers shop and make decisions in the store. The result is a digital divide between what consumers do and what retailers deliver. This gap not only threatens overall revenue, but requires retailers to reset the way they measure and invest in digital efforts."

For more information about the study's findings and methodology, please take a look at the infographic or download the full report.

By Daniela La Marca